AFC Compliance – Outlook on 2023 and the near future of the domain

#rethinkcompliance Blog | Post from 23.01.2023

In this blog post, I would like to provide an outlook on 2023 and the following years, this means the near future of our domain that is dedicated to fighting financial crime. As always with such outlooks, this one does not claim to be complete, but is a mixture of subjective perception and observation and objective analysis.

As there are different perspectives on the area of “Anti-Financial Crime Compliance”, I would like to start by outlining what is meant by this, without going into too many details. This is followed by an assessment of 2022 and an outlook for the near future. At msg Rethink Compliance, we summarize the following areas under the term “Anti-Financial Crime” (AFC). Each of these areas is to be regarded individually even if there are overlaps between them. For this, see our Glossary.

- AML/CFT Compliance. The acronym stands for anti-money laundering (AML) and identification of terrorism financing (Combating the Financing of Terrorism), sometimes abbreviated as CTF (Counter-Terrorist Financing).

- KYC Compliance. This acronym stands for Know Your Customer (KYC), although we define it a bit broader and interpret “C” it as “Counter party”, commonly meaning the business partner, whether the business partner is a supplier, a development partner, sponsoring partner, sales agent or customer.

- ABC Compliance. In our context, this is a common acronym for fighting corruption and bribery (Anti-Bribery & Corruption).

- Fraud Prevention. Interestingly, there seems to be no comprehensive acronym for the English term fraud prevention. However, only could derive FPD from Fraud Prevention & Detection.

- ESG Compliance. Implicitly, ESG compliance consists of KYC, ABC and fraud prevention. As this is not clear to everyone, I list this topic, which also includes the block Corporate Social Responsibility (CSR), individually here.

- Sanctions. The area of finance embargo monitoring, which itself is already covered by the areas AML/CFT and KYC, will also be listed here individually.

Explicitly excluded from this consideration are the areas of tax evasion, which overlaps with AML and KYC, and the area of anti-cybercrime, which in a broader sense is part of fraud prevention but which is an individual topic in the area of industrial espionage, for example. We take this into account in the msg group and offer specialist expertise in the form of msg security advisors.

For 2022, the Financial Crimes News platform provides what I consider to be a very good and structured overview and analysis of events, including interesting questions (Fighting Financial Crime in 2022 – Dashboard by FCN). Since almost every software vendor in the field never tires of commenting on the events of the year, sometimes more, sometimes less, I don't want to join the ranks.

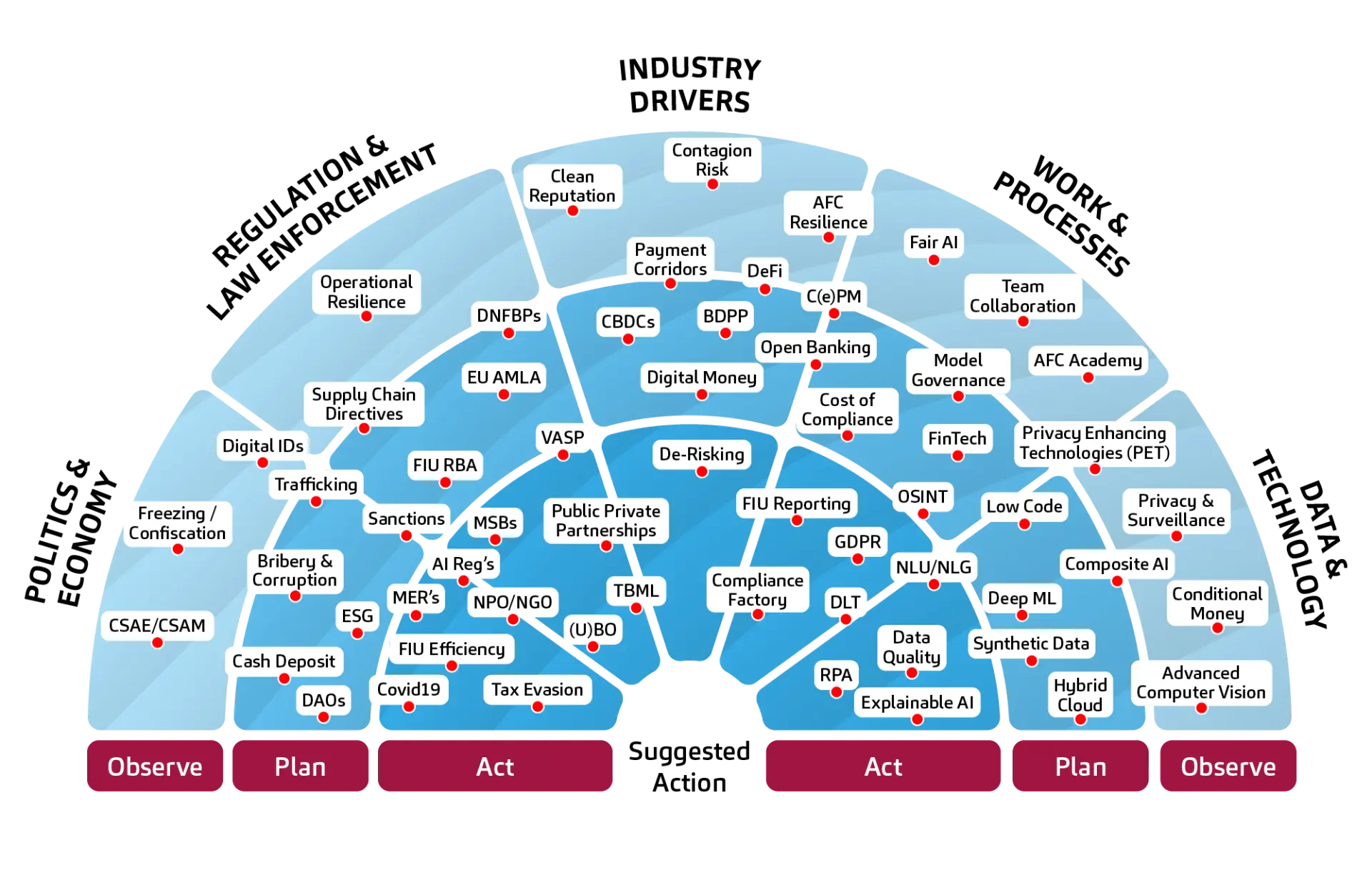

We are continuously and systematically investigating the market. For this, we have developed our AFC Radar, in which we take a closer look at all stakeholders, collect observations, identify trends, and then examine the extent to which these have significant impact on AFC compliance. This includes politicians, regulators, watchdog organizations or the affected industries such as banking, insurance and others. But we also consider changes in the type of work, availability of technologies, system suppliers and software providers as well as the possible uses of the applications. We attempt to corroborate these observations using four consideration perspectives. The following illustration gives a rough impression of the multitude of drivers considered.

Basically, we can assume that these drivers are motivated by a general desire to improve the fight against white-collar crime. Following a recent discussion about artificial Intelligence (AI), I recently tried ChatGPT, an advanced chatbot prototype from the US-based OpenAI. I asked “Got any ideas to improve combating financial crime?” and received the following answer from the AI-driven bot[i]:

- Improved recognition and monitoring systems: Using advanced analytics and machine learning, financial institutions can more effectively detect and monitor suspicious activities.

- Improved collaboration and information sharing: Financial institutions can collaborate and share information about potential finance crimes, which will help better detect and prevent these crimes.

- Increased regulatory oversight: A stronger regulation framework and a stricter enforcement of regulations can help deter financial crimes by increasing the risk of detection and punishment.

- Better education and awareness: Educating the public about financial crimes and how to protect themselves may reduce the number of victims of these crimes.

- Improved international cooperation: Financial crime often crosses national borders, making international cooperation essential to effectively combat it. This can include sharing information and coordinating enforcement efforts.

- Using technologies: The use of blockchain and other distributed ledger technologies can help increase transparency and traceability of financial transactions, making it harder for criminals to operate.

The underlying transformer-based machine learning model[ii] has been trained using a large dataset of conversations. Mainstream dominates here, not necessarily facts. Thus, these six points mentioned by ChatGPT hardly come as a surprise. This remains the case if one further questions each individual aspect of the above answers. Even on the question of how this can be implemented, the model provides clues. We have already pointed out the particular importance of transformer models, including the newer feedback transformer architectures[iii], for regulatory compliance at various conferences, as well as the problems, especially with respect to perception bias of AI/ML. ChatGPT has attracted a great deal of attention and received much acclaim. However, there are wholly different questions critical to this specific artificial intelligence that we will not pursue here now. Nevertheless, one can predict that in the area of AFC compliance, the use of technology - which ultimately includes AI/ML - will continue to grow to increase effectiveness and efficiency.

For the near future of AFC compliance, we also see the following additional topics, signals and trends, among others:

Regulation & Supervision. Under this heading I have tried to present our main observations on the requirements and behaviors of regulators and supervisory authorities, without going into new laws or adaptations of existing laws (AMLA (Anti-Money Laundering Act), LkSG (Lieferkettensorgfaltspflichtengesetz), EU Supply Chain Directive, EU AI Act and many more). I have also left out specific industry topics such as Target2 in payment transactions, which is to be successfully implemented in the EU this year, the real estate sector, which is facing tighter regulation and supervision, DNFBPs (“Designated Non-Financial Businesses & Professions”) which will see similar challenges or the challenges in payments and eCommerce. Instead, I will deal with the generally applicable topics below.

- Policy & Control Management. Preventing ethical misconduct of employees without having to introduce additional rules and controls and taking into account that human beings do not necessarily act rationally in all situations, demands a risk management approach that works on a behavior basis (“Behavioral Risk Management”). This can be used to trigger so-called "nudges", i.e., thought-provoking and reminder devices, to help employees behave within the framework of the rules and specifications. This is another approach to prevention that can prevent problems from arising in the first place. There is already initial experience of implementation in this area, although there are as yet no best practices.

- Compliance Resilience. Resilience in this context follows Markus Brunnermeier's concept of resilient societies.[iv] This states that it is not only about resilience but about flexible adaptability to new conditions in such a way that societies are not permanently damaged in the long term. We are seeing an increased focus among international regulators, but also increasingly within the EU, to demand such resilience and also to review it. This goes hand in hand with a significantly reduced response time for obligated parties. Backtesting, stress testing and ad-hoc simulations of the monitoring and screening solutions used, as well as the adequacy of the risk analyses, represent the major challenges here.

- Risk Assessment & Analysis. The aforementioned regulatory requirements for companies to become more resilient and agile, also with regard to compliance, leads to a clear emphasis on the regulatory risk model and thus the areas of risk assessment and risk analysis. Let me put it this way: While an annual look at compliance risk assessment has been sufficient in the past, this will no longer be the case in the foreseeable future. While we don't see an indication to address the topic on a weekly basis, we do see an indication to address it on a quarterly, if not monthly basis, not to mention ad-hoc requests. This will force compliance departments into a different form of implementation planning and control, which has long been standard in other areas and is very closely linked to the area of “Enterprise Performance Management”. In the near future, however, this will be more of a free skate. However, backtesting, which in some countries and regions has so far been treated more as a marginal issue in regulatory compliance, will become mandatory. What justifies exactly those thresholds, exactly those ratios, and exactly those chosen exclusion criteria? Officers have better answers to these questions and can point to a systematic approach. Also part of this topic block are ownership analyses of legal entities in order to identify the beneficial owner(s) in compliance with the law. Here, we participated in the FATF consultations on Recommendation 24 in 2022. The uncoordinated and patchy implementation of transparency registers within the EU and the lack of governance on the part of the authorities mean that this topic will continue to be a focus and challenge for officers in 2023 and the near future. There is currently no improvement in sight. Please see our blog post for more information: From a Backup Register to a Full Register – Are the Alterations by the German Act TraFinG Enough? However, there are more and more market intermediaries offering solutions usually with a regional focus (for example, Russia and Ukraine or Africa) for qualitative automation. This is also an area where the use of technology will continue to grow rapidly in line with the tightened sanctions regimes. New challenges are also emerging from the field of ESG ("Environment, Social, Governance"), which are spilling over into institution or company-specific risk models and risk analyses from various regulations.

- Public-Private Partnerships & Private-Private Partnerships. In our opinion, both will receive attention in the future and will be necessary to improve the situation in the fight against incriminated funds. However, it needs to start with the public-public partnerships. One would think that the Financial Intelligence Units (FIUs) of this world would find it easy to share data in such a way that concrete starting points for law enforcement and prevention can be efficiently derived from it. There are many reasons why this can only be agreed to a limited extent. One major reason is different data protection regulations and, of course, different politically motivated systems. Since the latter will be difficult to influence, in the area of data protection, reference should be made to technological progress that simplifies exchange using so-called "privacy enhancing technologies," or PET for short. I would also like to refer you to our blog post on this topic. Privacy-Enhancing Technologies (PETs) in the Fight Against Financial Crime. This is also an approach for the other form of partnerships. Purely private-sector partnerships are seldom seen as an effective means of improving the fight against white-collar crime. The fear of rejection by the supervisory authority and the fear of data protection problems are too great here. But how is KYC compliance to be ensured and made more effective in the future without exorbitantly increasing costs and/or the associated risks? In our opinion, this is only possible through cross-company exchange and cooperation.

In the area of industry drivers, I would like to mention the following from the sum of the identified observations:

- Metaverse & Web3. The first steps into metaverse for bank and financial services providers and even more so for consumer brands have been taken. Not much else has happened so far, despite billions in investment, although the gamer metaverse is clearly on the rise with Roblox and Fortnite. The sober balance of the metaverse may also be due to the swelling dispute over how identities can be established and protected, who owns what data, and what regulation can/will be used and how. Web3 is based on the idea that ownership of data is shared between creators and users, thus avoiding domination by large corporations. It is supposed to be the decentralized continuation of Web2, i.e., the Internet as we know and experience it today. That’s the theory. In fact, a complete digital economy is to be created. The first ATMs in the metaverse already exist, and the payment service providers are getting ready. Nevertheless, we still see the coming months here as more of a playground for advertising and marketing. Considering that it took 15-20 years for the Internet to hit the banking world, but only 5-6 years for app-based mobile banking, we may assume that it will at least not take longer with the metaverse, especially considering that most areas of smart cities will also need Web3 as a basis. The closer you are already to cryptocurrencies, NFTs and smart contracts with your business model, the faster the metaverse and Web3 will gain relevance, also in the AFC environment.

- Smart Contracts & NFTs. Let’s start with the simpler one, Non-Fungible Tokens (NFTs). These unique proofs of ownership are a core component of the Web3 but are already well advanced in their broad adaptation. Apart from their existence in digital art, trading and tokenization represent interesting features that suggest NFTs will continue to grow in the near future. Similar to the metaverse, the consumer goods industry is leading the way here. We should therefore not just reduce NFTs to an asset class but perceive them as an interesting technology. This is even more true for smart contracts. These are digital contracts in the form of an application based on blockchain technology. These smart contracts can act through their own application when certain conditions are met and do not require human supervision. The parties to the contract are defined by tokens. The first financial products based on smart contracts are emerging to facilitate trade finance. Smart contracts are also increasingly being used in the supply chains of commercial and industrial companies. In the future, we expect to see more complex trading constructs that are subject to volatility and therefore also require smart adjustments to these self-executing contracts. But the extent to which this helps combat trade-related money laundering depends on the acceptance and increasing adaptation of the technology.

- Crypto Currencies. Away from being viewed as a speculative asset rather than a substitute for fiat currencies, this asset class will continue to endure. Whether you call the crypto winter a structural collapse or a controlled crash, it will not change the fact that crypto currencies are here to stay. From the perspective of AFC compliance, they are a risky asset. It is imperative that this be reflected in the risk model and risk analysis, and it will leave many anti-money laundering officers with question marks. After the collapse of the trading platform FTX and now alleged transparency issues at Binance, crypto exchanges are facing an increased regulatory attention. In these cases, however, it is more in terms of unraveling potential fraud scenarios, specifically in the area of financial reporting. Either way, crypto exchanges are in for at least one more frosty spring in the coming months after the crypto winter.

Effectiveness & Efficiency. We are inclined to always think of this point as technologically motivated. But that’s not true. Although the topics of automation and AI/ML play a major role in the discussion in this area, it would be fatal to assume that technology alone can bring about an improvement in the situation. Technology – whether new or changed – should always entail an adaptation of processes and, if necessary, of the organizational structure, or this should even precede the technology.

- Compliance Resilience addresses the effectiveness perspective and represents an increasing challenge for obligated parties. To manage this efficiently, concepts are needed. Technologies and techniques are available. We will present such a concept in the scope of our AFC Governance initiative soon. We see this as a long-term focus for obligated parties, system providers and integrators in the coming years.

- Technology Use. In the same corner, I would see the increasing use of automation techniques as well as AI adoption. In addition to the further use of robotic process automation (RPA), the topic of entity resolution (ER) should also be mentioned, which will increasingly contribute to an improvement in quality and thus to an automation of decisions in the area of KYC processes. With regard to AI, reference should be made to the bunq ruling[v], which will certainly result in further AI adaptation in regulatory compliance. In our opinion, little will change in the use cases. These are known and should be implemented in a well-considered manner – taking into account the application guidelines of the regulators, but also the specific regulation (keywords here are EU AI Act or New York AI Bias Act, among other things). AI is a supplement and not necessarily a replacement of existing rule-based systems. Again, our research into the vendor landscape (AML/KYC application providers) shows increasing openness, ranging from existing interfaces to AI models to embedding these models. Cooperation and coexistence instead of competition and substitution, in other words. However, the area of explainable AI would have to be mentioned here as a key technology in the case of a (partial) replacement of rule-based systems. Due to the fact that there is hardly reliable training data − not to mention fuzzy FIU reports and their underlying data − it is all the more important to recognize model biases and understand how results are found. In addition, mention should be made of "digital twins" for handling peaks in case processing as well as the area of "Natural Language Processing" (see the above mentioned ChatGPT) for case disposition and/or pre-assessment of raised cases. As AI/ML become more prevalent in the AFC space, the issues of operations and reliable and efficient deployment ("Machine Learning Operations" (MLOps)) will become more important.

- Data Integration, Data Quality & Data Protection. Data quality is an idle topic that is at least as old as my professional career to date. On the one hand, some regulators, including Bafin, have called for measures to be taken to improve data quality where necessary. On the other hand, the quality of the data is of much higher importance when working with AI/ML methods. In this respect, there are two motivations in AFC compliance for taking action, however unwelcome the topic may be. An evaluation of the corresponding application notes of Bafin on this point can be found here: Item 6 of the AuA BT - BaFin Concretizations on Monitoring Systems helpful, Impact of Poor Data Quality on Compliance. Data integration is part of data quality, but it poses its own challenges in digital transformation, especially in the traditional banking environment, including AFC. This is less true for neo banks due to the lack of IT system history. That the topic is strategically relevant has been known for some time. Whether it will be addressed in the current economic environment remains questionable. The issue of data protection is also not a new one. But in the context of the public-public, public-private and private-private partnerships mentioned above, it will inevitably be a pressing issue for FIUs, officers, and also industrial companies in compliance in 2023 and subsequent years. I would also like to mention synthesization of data related to the AI/ML technologies mentioned above, which is very beneficial for backtesting. Especially the latter will be of great importance this year, as described above in the area of regulation, for model governance, the monitoring of risk models.

- Total Cost of Ownership. With all the IT initiatives, the multitude of systems, system components and high integration points in the area of AFC, the costs of AFC compliance are also becoming a focus of attention in the current economic situation. Besides the standardization of systems, the homogenization of the system landscape and the improved integration of data, the question is increasingly being asked whether a simple reduction to a one-vendor strategy is not just as problematic as the other extreme, the best-in-class strategy. The discussion is rounded off by outsourcing on the one hand and insourcing on the other. Both are also driven by one or the other regulation, for example AMLA. In addition to the actual software systems, the operating models are also put to the test in AFC compliance.

One could write a lot more, but in my opinion the points listed above represent a good mix of currently discussed challenges and those to be expected in the near future. Unsurprisingly, AFC compliance remains a challenging topic in 2023, both in terms of effectiveness and the need to improve efficiency and proportionality of resources.

[i] ChatGPT Dec 15 Version in a Free Research Preview; Original Question: “Got any ideas to improve combating financial crime?”

[ii] Transformer refers to a deep learning model based on sequential data input, but which can be parallelized, helping to significantly reduce training time.

[iii] The term “Feedback Transformer” originates from a research paper dated January 25, 2021 by the authors Angela Fan, Thibaut Lavril, Edouard Grave, Armand Joulin and Sainbayar Sukhbaatar, all from Facebook AI Research, in which the limitations of traditional transformer models were identified as well as the possible elimination of these restrictions. We tend to find the term misleading and usually use the term “recursive transformer”. Here, all layers in a vector are fed into the model memory per time step, not just the representations of the lower levels.. This results in much more powerful models.

[iv] Compare Brunnermeier, M. K. (2021), The Resilient Society, 2nd Edition.

[v] On October 18, 2022, the competent court in Amsterdam ruled that Neobank bunq could very well use artificial intelligence methods to combat money laundering. Among other things, this has so far been rejected by the Dutch central bank. However, the ruling also confirms shortcomings of the bank in the effectiveness of monitoring, especially in the area of customer risk classification. Both DNB and bunq see their opinions confirmed in the ruling. With regard to the use of modern technology to combat money laundering, DNB has announced on the basis of the ruling that it will enter into a dialog with the financial sector

Author

Dirk Findeisen

Managing Partner

Expert for Financial Crime Compliance | 20+ Years of Experience in Governance, Risk & Compliance (GRC), Data Management, Advanced Analytics, and Corporate Performance Management | Author, Speaker, Lecturer