We are rethinking financial crime compliance

We offer support and advice on the digital transformation of the Financial Crime Compliance Office and processes. Regardless of whether it is about data-driven decision support, Robotic Process Automation (RPA), the introduction of Artificial Intelligence (AI), the selection and use of technology, feasibility studies, strategic transformation or topic prioritization. With extensive Run-Maintain-Change services, we support our customers along their operational compliance processes. We also provide specialist advice and operational support, from risk analysis to suspicious activity reporting and entity-wide governance.

Our customers benefit from over 200 years of combined consulting experience gained from serving 1,300+ financial institutions in 100+ countries.

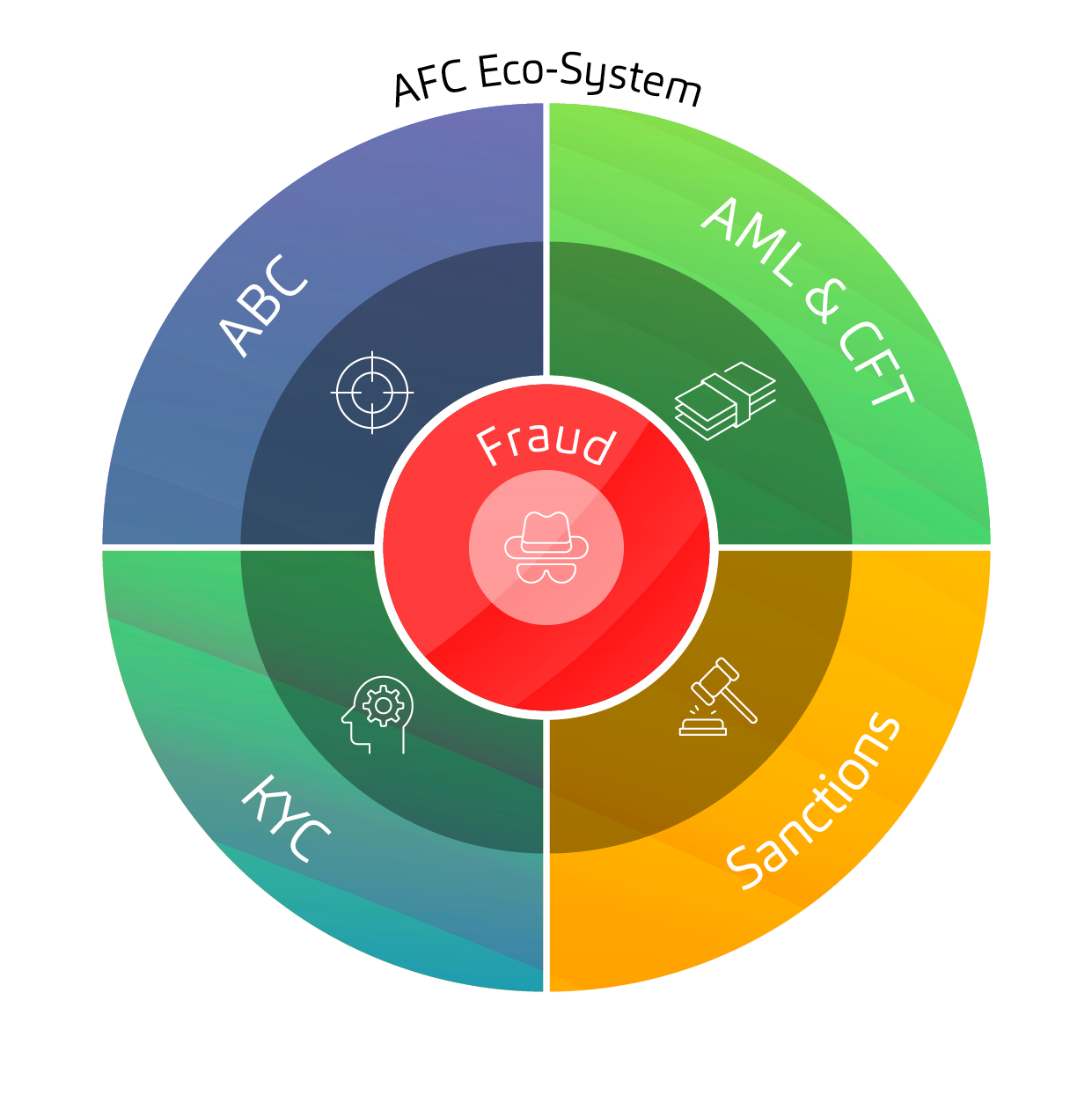

Our expertise

- Protection against, and identification of money laundering for all industries and segments, including the preparation of Suspicious Activity Reports (SARs)

- Guidelines and best practices from international watchdogs and industry organizations

- New typologies, hidden networks, internal fraud, trade-based money laundering, and money laundering in correspondent banking and trade finance

- Monitoring of sanctions lists as well as monitoring and analysis of payment flows to identify and stop terrorist financing

- Identification and management of relationship risks associated with operations and compliance risk management

- Fuzzy and phonetic searches, profiling, identity verification and digital due diligence

- Identification of business partners, related parties, and ultimate beneficial owners

- Sanctions, watchlists and politically exposed people (PEPs) checks

- Linkage to operational onboarding and decision-making processes and fraud prevention

- Process reviews and digitization

- Screening and ongoing monitoring of relevant sanctions lists (e.g. EU, UN, OFAC)

- Embargo checks in international trade, finance, and payment transactions

- Verification of goods lists, with a focus on dual-use items

- Identification and screening of business partners, related parties, and ultimate beneficial owners (UBOs)

- Transaction and payment screening to detect sanctions-related risks

- Compliance management of business partners throughout the lifecycle: from initial screening to continuous monitoring of changes in circumstances to termination of the partnership

- Monitoring of relevant business partner related (data) events and transactions for early identification of "red flags" and fraud risks in ongoing business activities with these third parties

- Detection and prevention of fraud as a predicate offence with proceeds subject to money laundering

- Risk scoring, behavioural screening and link analysis to identify fraudulent patterns

- Strategic integration of fraud prevention into existing AFC compliance and risk management systems

Your advantages

Comprehensive service portfolio

End-to-end compliance services – from ad-hoc advisory and partial or full business process outsourcing to advanced digital and AI-powered compliance solutions

Compliance, done efficiently

Smarter, faster, and more cost-efficient regulatory compliance – enabled by high automation and economies of scale

Effective compliance in practice

Bridging the gap between technical compliance and real-world effectiveness – reducing the risk of regulatory breaches and reputational damage

Governance as a service

Compliance governance as a service – seamlessly complementing existing monitoring and control frameworks

Our portfolio

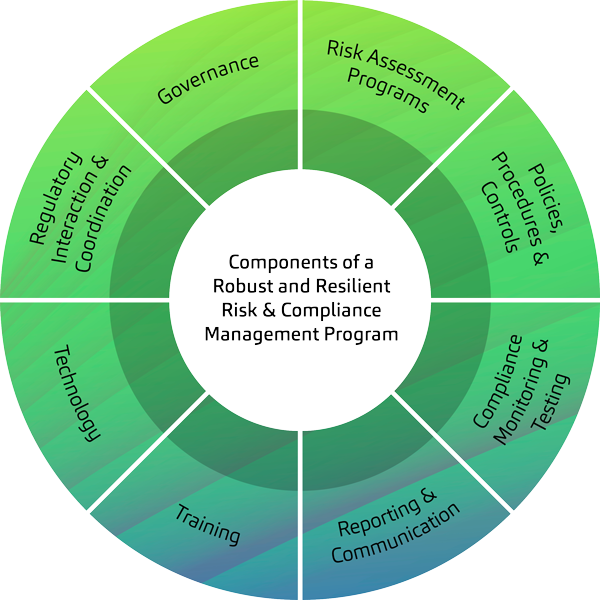

We offer a broad portfolio of consulting services as well as process and technology support to facilitate, automate, and sustainably change the workflow and experience of the Compliance function: from training, health checks, or risk analyses to AI-based data products and compliance bots to risk assessment solutions and governance systems for Group Compliance.

Services

Solutions

Industries

Combating white-collar crime is no longer a problem of the financial sector alone. Whether it is about money-laundering prevention for goods traders, mobile payment systems and bank-related services in telecommunications, or business partner compliance across the industry in general as part of anti-bribery and corruption - we help you through our experience in the following industries:

Financial Services

Banks, insurance companies, leasing and collection agencies, money services businesses

Telecommunications

Network operators

Production/Manufacturing

Chemical, pharmaceutical, automotive, metal and mining industries

Trade

B2C and B2B trading companies

Technology & Services

Software companies and consultancies

This industry knowledge pays off for you. "One-size-fits-all" approaches are neither operational nor desirable, and are generally rejected by regulators. Moreover, future viability requires looking beyond one's own borders. Numerous new fields of action can be opened up in cross-sector platforms and networks. Together with msg advisors, we develop ecosystems that give your visions thrust.